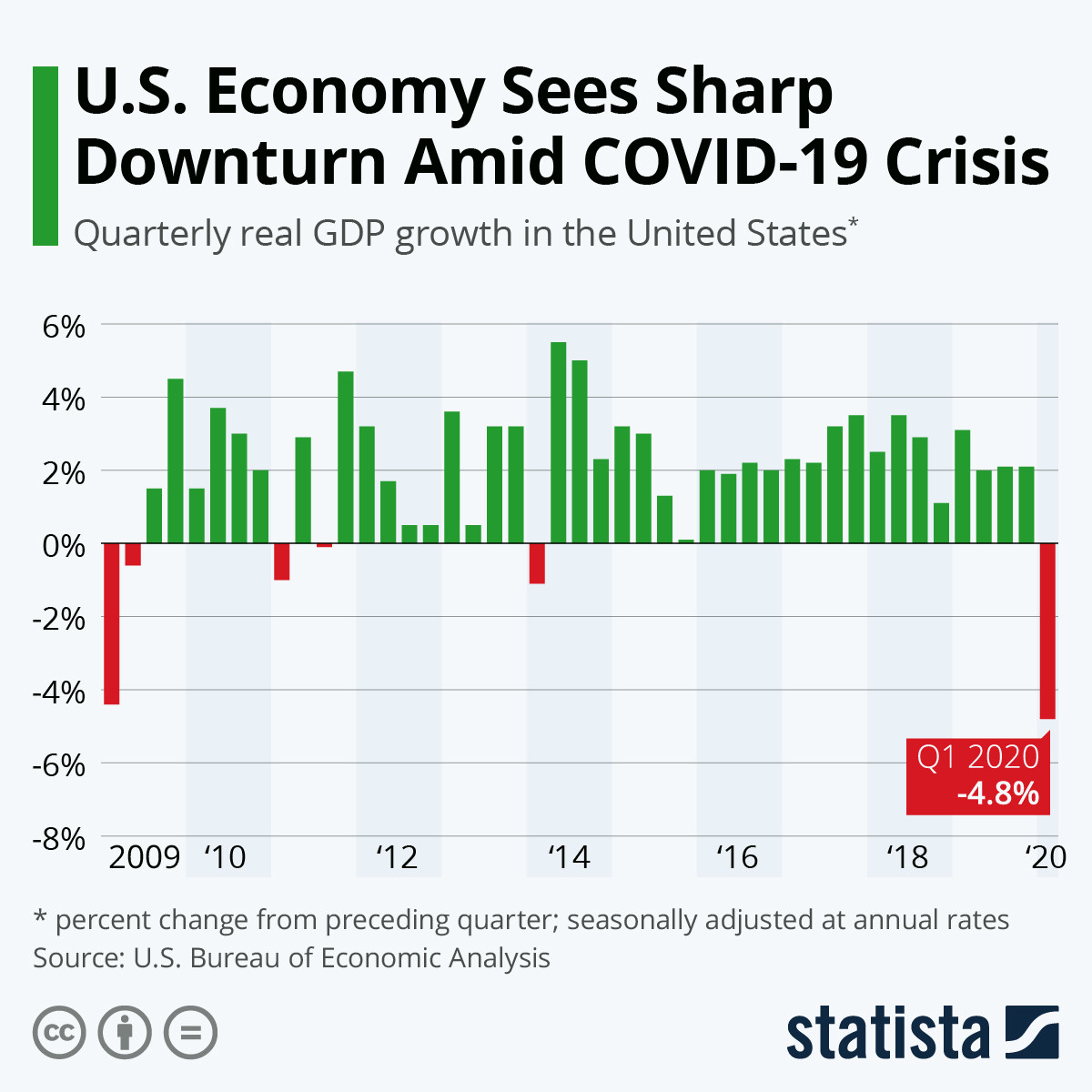

The repercussions of the Coronavirus Pandemic on the global economy are proving to be devastating, potentially surpassing the challenges faced during the Great Depression of 1929. As Covid-19 continues to wreak havoc on a global scale, with millions of individuals in forced lockdowns and businesses succumbing to bankruptcy, the magnitude of the problems and challenges becomes increasingly evident. This article delves into various scenarios that highlight the profound economic impact of the ongoing crisis.

- Record Unemployment and its Consequences: The surge in unemployment directly correlates with a significant increase in crime, bankruptcies, and homelessness. A populace devoid of financial reserves accumulated during periods of economic growth expects governmental support during challenging times. However, the ability of different nations to provide such assistance varies, potentially leading to widespread financial instability.

- Bank Failures and Cash Restrictions: The pandemic-induced economic strain may lead to the failure of banks, creating difficulties in insuring deposits. This situation echoes the 2008 Banking Crisis, albeit on a larger scale. Governments face challenges in safeguarding bank deposits, and individuals may find themselves at risk of losing their savings. Cash withdrawals and holdings could face restrictions, exacerbating the financial turmoil.

- Government Bailouts and Their Limitations: Massive government bailouts may be implemented to address economic downturns, yet their effectiveness in altering the prevailing trend remains uncertain. Despite these financial injections, the economic course may continue until it naturally concludes, reflecting a prolonged period of economic uncertainty.

- Deflationary Pressures: Deflation becomes a significant concern, resulting in lower prices for goods but accompanied by decreased wages. The value of cash relative to assets like stocks, houses, and groceries may increase, but the overall money supply diminishes. This deflationary trend stems from the eradication of accumulated debts, discouraging borrowing by individuals and businesses concerned about the uncertain future.

- Long-Term Quarantines and Business Disruptions: Prolonged and recurring quarantines, disrupting regular business operations for extended periods (ranging from 3-24 months), are a possibility. Scientific uncertainties and fear may drive such extended lockdowns, creating a cautious environment and impeding the resumption of normalcy.

- Societal Shifts and Insecurity: Insecurity within society may lead to a less inclusive mindset, with individuals gravitating towards smaller, more homogeneous groups. This shift can manifest in various forms, such as political, ideological, racial, or even based on personal choices like food preferences.

- Increased Distrust and Blame Among Nations: International relations may suffer as distrust and blame between nations intensify, resulting in heightened restrictions. Countries may prioritize national self-preservation over global cooperation, viewing aid from other nations with skepticism and suspecting ulterior motives.

- Governmental Control and Authoritarian Measures: Governments may establish precedents and laws to enhance control and surveillance of citizens, employing more draconian measures. While framed as efforts to maintain societal health, such measures are likely to face opposition from those opposed to authoritarian control.

- Reaction Against Big Businesses and Wealth Disparities: Large corporations and wealthy individuals, especially those with questionable ethics, may face a public backlash. Platforms like Google and Facebook, along with the banking sector, may come under scrutiny as the public questions their practices.

- Rise in Mental Stress and Disorders: The economic upheaval, coupled with personal finance challenges and unpredictable changes, is anticipated to lead to a significant increase in mental stress and disorders among individuals.

In light of these economic challenges, it is imperative for individuals to explore supplemental income streams to safeguard their financial well-being. Numerous opportunities exist, and individuals are encouraged to conduct thorough research. By proactively seeking ways to earn extra income during the Covid-19 era, individuals can better navigate the uncertainties and alleviate the stress associated with reduced income and job losses. It is essential to embrace financial resilience and seek financial peace of mind in these challenging times.